Over the past few months, I’ve been on several prospect calls, during which I've heard increasing frustration with the large marketing suites. While it’s common to hear companies complain about vendors, especially those they pay millions to, what I’m hearing lately seems to resemble a trend more than an occasional complaint. Two of the companies I spoke with used the exact phrase (which I hadn’t heard of) – “Suite Fatigue.” The general sentiment is that many organizations have been using the same marketing suite for a decade or more and have now discovered that they are no longer deriving incremental value from their investment.

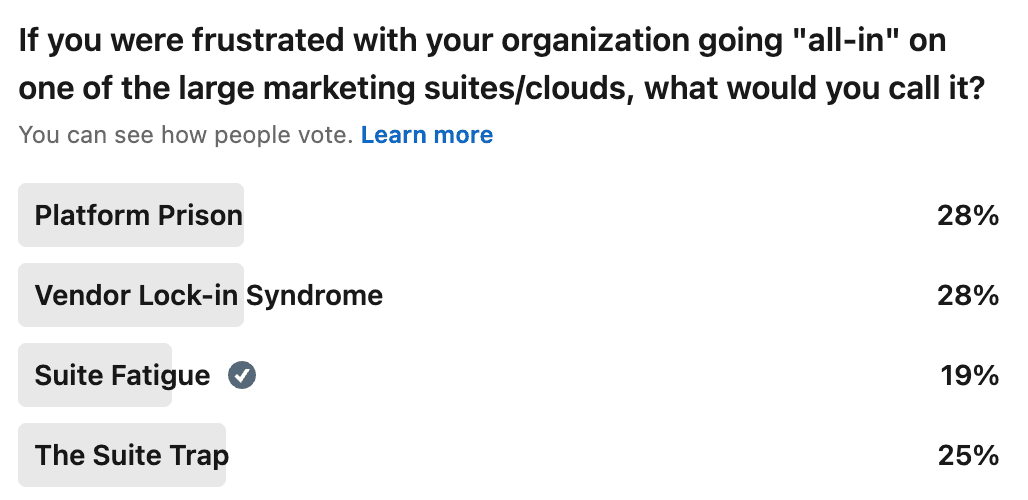

For fun, I asked folks on LinkedIn what they would call this, and here is what they said:

While it didn't get the most votes, I prefer the term “Suite Fatigue” because it isn't as harsh as some of the others! It reflects the fact that suites still have value, while recognizing the mounting frustration marketing teams are experiencing.

What is Marketing Suite Fatigue?

So what is "Suite Fatigue?" While it’s hard to explain precisely what “Suite Fatigue” is, the following are symptoms of “Suite Fatigue” I hear prospects say on these calls:

-

Price Increases - Our marketing suite vendor raises prices each time we renew, so we’re being asked to pay quadruple the original price we signed up for. Our marketing suite vendor treats us like an annuity. They expect [demand?] our business, and if we complain that we aren’t getting value, they blame us or try to upsell us services.

-

Implementation & UI Complexity - After decades of customer feature requests and versions, the marketing suites feel bloated and overly complex. It’s as if you require a PHD in the marketing suite to know how to use it. The result is low self-service adoption and a need for specialized teams or expensive consultants to assist end-users in obtaining what they need. In some cases, we hear that the cost of implementing marketing suites can take months or years and exceed the price of the suite products.

-

Vendor Lock-in - We feel trapped by the marketing suite vendor because we have invested heavily in their products, and they know it would be difficult for us not to renew, even at an increased price. Inertia, or the cost of switching vendors, is the primary reason for continuing to use the marketing suite.

-

Forced Version Migrations - On the occasions the marketing suite vendor releases a new version of one of its products, the latest version is often significantly different, requiring a new implementation, more costly professional services, new end-user training, and frequently costs 30%-40% more than the version being sunset.

-

Lack of Innovation/Roadmap Promises - Our marketing suite vendor has been slow to innovate its products compared to the “best-in-class” tools used by digital natives and more nimble competitors. The recent AI additions appear to be more marketing than innovation, as the underlying technology remains unchanged. While the marketing suites often have amazing, polished presentations and demos, many of the features we really need are perpetually on the “roadmap.”

-

Lack of Intra-suite Integration - While the main benefit of paying for the marketing suite is intra-product integrations, it’s clear that many of the products within the suite use different code bases and back-ends. Most of the products in the suite came from acquisitions and have only been superficially integrated.

-

Poor Customer Support - Our marketing suite vendor provides subpar customer support. Bugs go into a “P1” black hole, and the only way to truly get support is to pay for costly “managed services.” In many cases, users don’t even attempt to get support from the marketing suite vendor, instead choosing to join community groups/forums to seek help.

Do any of these sound familiar? Feel free to stack-rank your symptoms here to see how you compare to others:

As I’ve written in the past, there was a time and a place for large marketing suites. In some cases, organizations even use multiple marketing suites! I, myself, have worked extensively with Adobe products and was employed by Salesforce for a few years, so I’m familiar with the pros and cons of marketing suites. Many of the products obtained within marketing suites are excellent. But I do think that organizations going “all-in” on marketing suites is not always the best strategy in today’s Martech landscape.

The next generation of marketers will want more freedom and flexibility, rather than being constrained by all-in-one marketing suites. As people my age, who staked their careers on marketing suites, retire, they will be replaced by younger people who have less allegiance to the marketing suites. At some point, even the more established, slow-moving Fortune 500 companies will want to use the non-marketing suite technologies used at start-ups and high-growth companies. Unfortunately, no vendor can hide from The Innovator’s Dilemma!

The Cure? Composability!

Because so much of marketing is tied to data, I believe the future will revolve around the centralization of data in cloud warehouses and Composable solutions sitting on top of those warehouses. Composable architectures help bring data and marketing teams together, ensuring everyone uses the same data. Legal and privacy teams embrace Composable solutions because they minimize privacy and legal exposure related to customer data. AI also requires a single source of customer data, which will increase the demand for organizations to centralize their data rather than storing it in warehouses and marketing suites.

Of course, this doesn’t mean that organizations won’t continue to use individual products from marketing suites. At Hightouch, we use Salesforce for CRM, and I am a longtime advocate for Adobe Analytics. Hightouch has many clients that use specific marketing suite products, and in many cases, helps make them even better.

In the long run, I believe Suite Fatigue will drive a decrease in the number of organizations that go “all-in” on marketing suites. While buying marketing suites has been the “safe” choice for the past decade, soon keeping the marketing suite will feel riskier than switching vendors.

I expect it to take several years for this trend to unfold because marketing suites take a while to un-implement. The unbundling of the marketing suite is likely to begin with organizations moving away from one or two of the suite's products (e.g., ESP, digital analytics, etc.). Then, every few years, another marketing suite product may transition to a different vendor, leaving only a few remaining. Ironically, one of the key drivers of companies scaling back marketing suite investments is the release of new product versions.

For example, Adobe’s push to migrate clients from Adobe Campaign to the latest version (Standard, Classic) or Adobe Journey Optimizer (AJO) may prompt companies to consider tools like Iterable or Braze. When I worked at Amplitude, Adobe’s push to get companies to migrate from Adobe Analytics to Customer Journey Analytics (CJA) was a key factor in checking out Amplitude or other digital analytics tools. At Hightouch, we see many companies being pushed towards Salesforce Data Cloud (Data 360) and Adobe RT-CDP, engaging with us about our Composable CDP product.

Want solutions for Suite Fatigue?

If you’re recognizing signs of Suite Fatigue but aren’t sure what a realistic path forward looks like, you can check out my follow-up Suite Relief post or schedule time to chat with me.