There's a famous business theory called “The Innovator’s Dilemma,” which Clayton Christensen documented in a book in the 1990s. The primary tenet of the theory is that large incumbent technology vendors often lose to newer disruptive vendors.

As my new role at Hightouch engulfs me in the Customer Data Platform (CDP) space, I have realized that the CDP landscape is actively experiencing the Innovator’s Dilemma – specifically because of composability on data warehouses. Every CDP has been impacted by this sea change in how data is stored and used at the enterprise, and I’ve seen firsthand how Hightouch has disrupted incumbents in the category. In this blog, I’ll dive into the Innovator’s Dilemma and map out how this impacts CDPs.

What is the Innovator’s Dilemma?

In short, the Innovator’s Dilemma states that large technology vendors lose to newer disruptive vendors. Interestingly, the incumbent vendor's failure is usually not a result of doing something wrong. Incumbent vendors have large client bases, and they work hard to continue to meet the needs of those clients by adding the most requested features. But the theory goes on to say that, eventually, their products fail because they either 1) become too complex, or 2) they have so much tech debt and so many clients, that it's impossible to adapt to new industry trends or technologies.

A classic example of The Innovator’s Dilemma is the Blackberry mobile device. In the early days of mobile phones, Blackberry dominated the business world. All of the cool businesspeople had a Blackberry. At the time, Blackberry continued to add incremental features to its phones, but it was blindsided when Apple launched the iPhone and started the touchscreen interface (you can watch a movie about this here). By the time Blackberry saw the iPhone, it was too late, since it would have had to throw away all it had built and start over to compete. And even if they could do that, they would have to convince all their current customers to switch to the new product and migrate them all. Instead, most customers went with the iPhone, and Blackberry became irrelevant.

Since I've been around for a while, I've repeatedly seen the Innovator’s Dilemma, especially in B2B SaaS. Here are a few examples that stick out in my mind:

| Legacy/Incumbent Vendor | Disrupting Vendor |

|---|---|

| WebEx, GoTo Meeting | Zoom |

| Oracle CRM, Siebel CRM | Salesforce, Hubspot, Zendesk |

| Netscape, Microsoft Internet Explorer | Google Chrome |

| Microsoft Office (Word, Excel, PowerPoint) | Google Workplace (Docs, Sheets, Slides) |

In some cases, legacy/incumbent vendors have disappeared, and in other cases, they have simply lost a lot of market share.

Vendors that avoided the Innovator’s Dilemma have displaced themselves before disruptors could displace them. The best example of self-disruption is Netflix. Netflix started its business by mailing physical DVDs to customers, which disrupted Blockbuster and eventually put it out of business. However, as the internet grew and home bandwidth increased, Netflix realized that streaming would be the future. Instead of waiting for a startup to provide a movie streaming service that displaced their DVD delivery service, Netflix disrupted itself and convinced its customers to switch from mail to streaming. This self-disruption took a lot of time and money, but it was the best thing Netflix could have done, and it is now one of the most valuable companies around.

The Innovator’s Dilemma & the CDP space

As my new role at Hightouch engulfs me in the CDP space, I have realized that the CDP landscape is actively experiencing the Innovator’s Dilemma. The CDP industry began over a decade ago with CDP vendors filling a critical marketing niche. Marketers needed a place to store all customer information to build and activate audiences for marketing campaigns. Working with internal IT teams and data warehouses was difficult, so they purchased CDPs to control their destiny.

However, in the last few years, many organizations have invested in cloud data warehouses (Snowflake, Databricks, AWS, Google, etc.) as the single source of truth for customer data. And since digital experiences are so critical in today’s digital world, these organizations don’t want customer data segregated into multiple places, which could lead to disjointed digital experiences. The desire to leverage customer data in the cloud warehouse has increased interest in warehouse-native (Composable) CDPs. Companies like Hightouch have allowed organizations to perform customer identity resolution, audience building, journeys, and activation natively on existing cloud data warehouse infrastructures. Cloud data warehouses and Composable CDPs have begun disrupting the traditional CDP space. At Hightouch, we have experienced 100+ percent growth rates, unprecedented investments, massive interest from agencies/consultancies, and many conversions from traditional CDP vendors. Just as you don’t see Netflix customers returning to DVDs or Blockbuster, at Hightouch, we have yet to see a Composable CDP customer return to using a traditional CDP.

When the Composable CDP disruption first began, incumbent legacy/packaged CDP vendors and analysts attempted to portray the Composable CDP movement as a “fad.” Industry analysts didn't include Composable CDPs in vendor scorecards. But, as more organizations understand the benefits of a composable (sometimes called “zero-copy”) approach to CDPs, the composable architecture is only gaining steam and forcing legacy/packaged CDPs to scramble for answers. How do I know this? By the fact that legacy packaged CDP vendors are now attempting to market their products as Composable CDPs or Composable CDP hybrids (e.g., Salesforce, Adobe, Tealium, Treasure Data)! Market research organizations like IDC have also cited this industry shift:

Source: IDC Market Forecast, Worldwide Customer Data Platform Applications Software Forecast, 2025–2029, #US51619624, July 2025

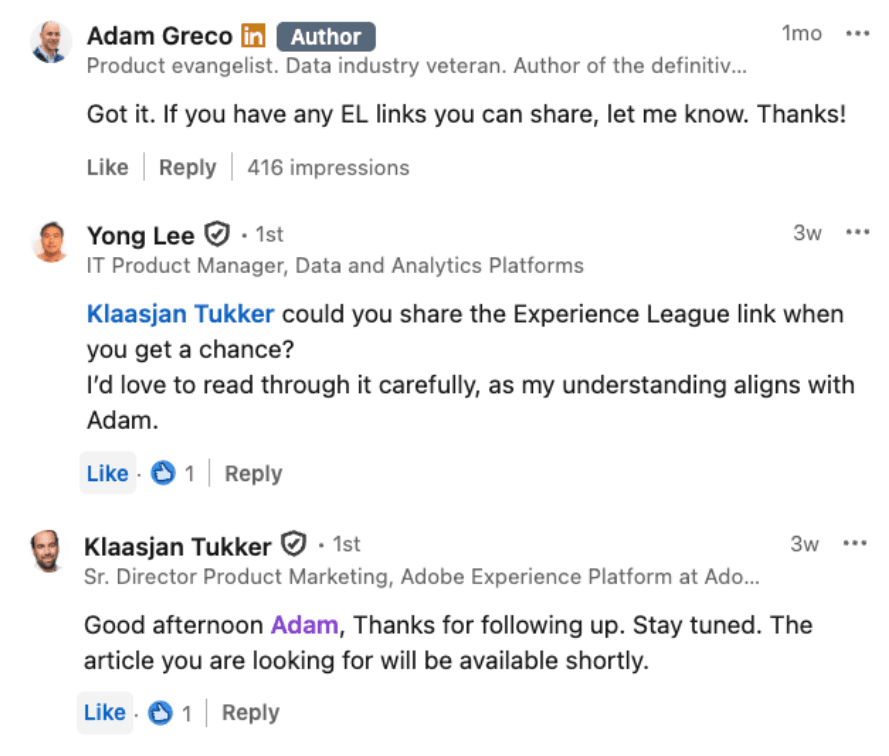

But saying you are a Composable CDP is very different from being a Composable CDP! I experienced this about a month ago when a product marketer from Adobe responded to a post of mine claiming that their packaged CDP (Adobe RT-CDP) was a Composable/zero-copy CDP (see full conversation here). Packaged CDP vendors have begun marketing themselves as integrating into cloud data warehouses, but we haven't seen much of this in the wild. Employees may claim they can do it, but haven’t provided documentation about it - at least so far.

Like past examples of the Innovator’s Dilemma, as the composable architecture becomes the new standard in the CDP space, legacy/packaged CDP vendors face several challenges:

- Infrastructure - Legacy/packaged CDP vendor products were built to work in a closed infrastructure that they control. They often have pre-built schemas and proprietary integrations. All customer data is meant to be stored in their platform, not one managed by cloud warehousing vendors. Replicating all existing functionality to work in a composable/zero-copy infrastructure is difficult.

- Customer Migration - Even if legacy/packaged CDP vendors could suddenly find a way to be composable/zero-copy, they would have hundreds of existing customers who would have to migrate from the old approach to the new approach, or the vendors would have to manage two entirely different back-ends (which would be expensive!).

- Pricing - Legacy/packaged CDP vendors often charge clients based on event volume, data storage, and/or user profile weight. Many of these pricing structures don’t apply to a composable architecture.

- Bureaucracy - Over time, incumbent vendors grow in the number of employees and layers of management. One effect of this growth is slower product innovation. The number of people who need to approve ideas or changes grows, and eventually the product stagnates. In addition, the bureaucracy forces the vendor to increase its prices to pay for all of the additional management layers. So instead of paying for cutting-edge innovation, you end up paying for bureaucracy.

Perhaps legacy packaged CDP vendors have composable CDP functionality, and it's not well-documented or adopted. I eagerly await hearing more. But even if it does exist, packaged CDP vendors still face the problem of migrating customers to a different architecture and reconciling pricing to what is, by all accounts, a more affordable approach. Are they really going to proactively migrate people to something that is less expensive than their core offering? It's a classic innovator's Dilemma!

The future

At Hightouch, we believe the move to the composable (warehouse-native) architecture is disrupting the CDP space. Legacy CDP vendors must adapt to this new model in the next few years or be left behind. Organizations currently investigating CDP solutions should include at least one Composable CDP in their evaluation so they can see the differences between the old and new approaches to CDPs. Implementing a CDP isn’t something you do every year, so your organization should think long-term and determine which CDP it wants today and five years from now.