Retailers live and die by product sales. But with e-commerce disrupting the industry, the landscape is becoming more competitive. Retailers are now leveraging the one thing that they have been collecting for years—customer data. A race has begun for every retailer to monetize this data, giving birth to a new industry: retail media.

This article will cover:

- What is retail media?

- Why should you care about retail media?

- How does advertising with retail media work?

- How to build a retail media network

- Best Retail Media Platforms

What is retail media?

Retail media is a new form of advertising that lets retailers leverage their digital assets and first-party data to deliver targeted, personalized advertisements to consumers on behalf of advertisers.

Retail media allows retailers to open up an additional revenue stream with higher margins, which is becoming crucial as the landscape gets more and more competitive through ecommerce. By creating retail media networks, retailers can sell ad inventory across various channels, such as websites, mobile apps, email, connected TV, in-store, etc., to prospective brands that want to increase product sales and target their ideal buyers.

Why should you care about retail media?

As a retailer, you're likely feeling the pressure from several challenges:

- Rising transportation costs

- High staff turnover leading to increased wages

- Higher raw material costs, which drive up consumer prices

These factors are squeezing already thin margins. In addition, changing customer behavior—marked by more customers happy to shop online—means that retailers need additional income streams to derisk any future changes. And that's where retail media comes into play, allowing retailers to use their first-party data for advertising.

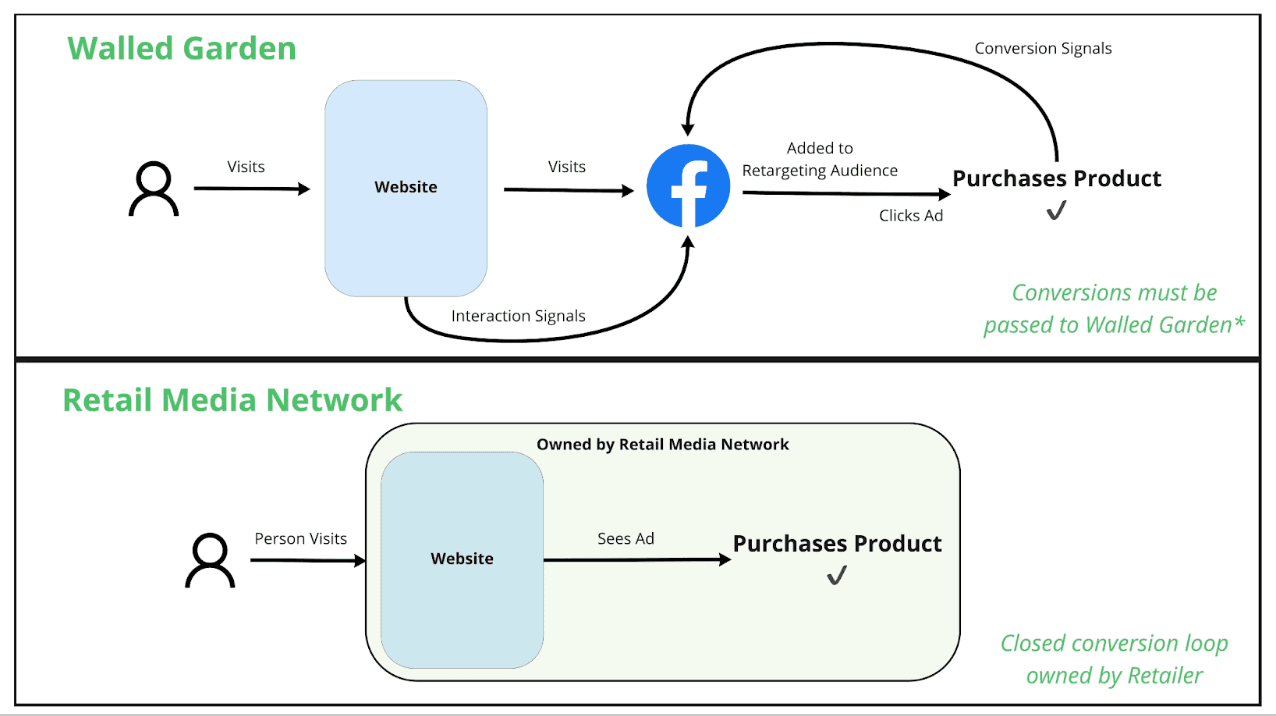

Retail media not only boosts revenue but also enhances the customer experience. Using your first-party data, you can present highly relevant ads that resonate with your customers. This targeted approach improves customer engagement and increases advertisers' return on ad spend (ROAS). Unlike walled gardens that require attribution to be passed back to the platform, retail media offers closed-loop attribution capabilities necessary for teams to overcome signal loss associated with the deprecation of third-party cookies. Thanks to this closed-loop attribution, major retailers like Amazon can leverage machine learning to optimize campaigns to maximize each advertiser's return on ad spend (ROAS) - often more effectively than their walled garden counterparts.

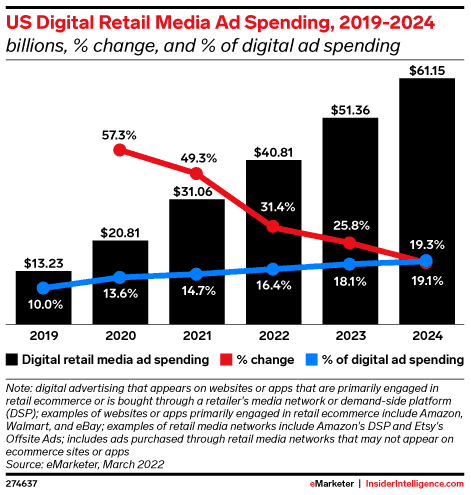

These foundational components come together to form what is being called "the third big wave of advertising." According to e-marketer, US digital retail media ad spending will grow by +24.8% to reach $129.93 billion in 2028, making up nearly 25% of all digital ad spending.

How does advertising with retail media work?

Two parties are involved in retail media: the retailer and the brand (or advertiser).

Retailers like Amazon and Walmart have a large reach among consumers and want to monetize that audience data. Often, this data is collected via a loyalty program, which allows you to collect user preferences, interests, and transaction data, which you can use to serve hyper-specific ads to them.

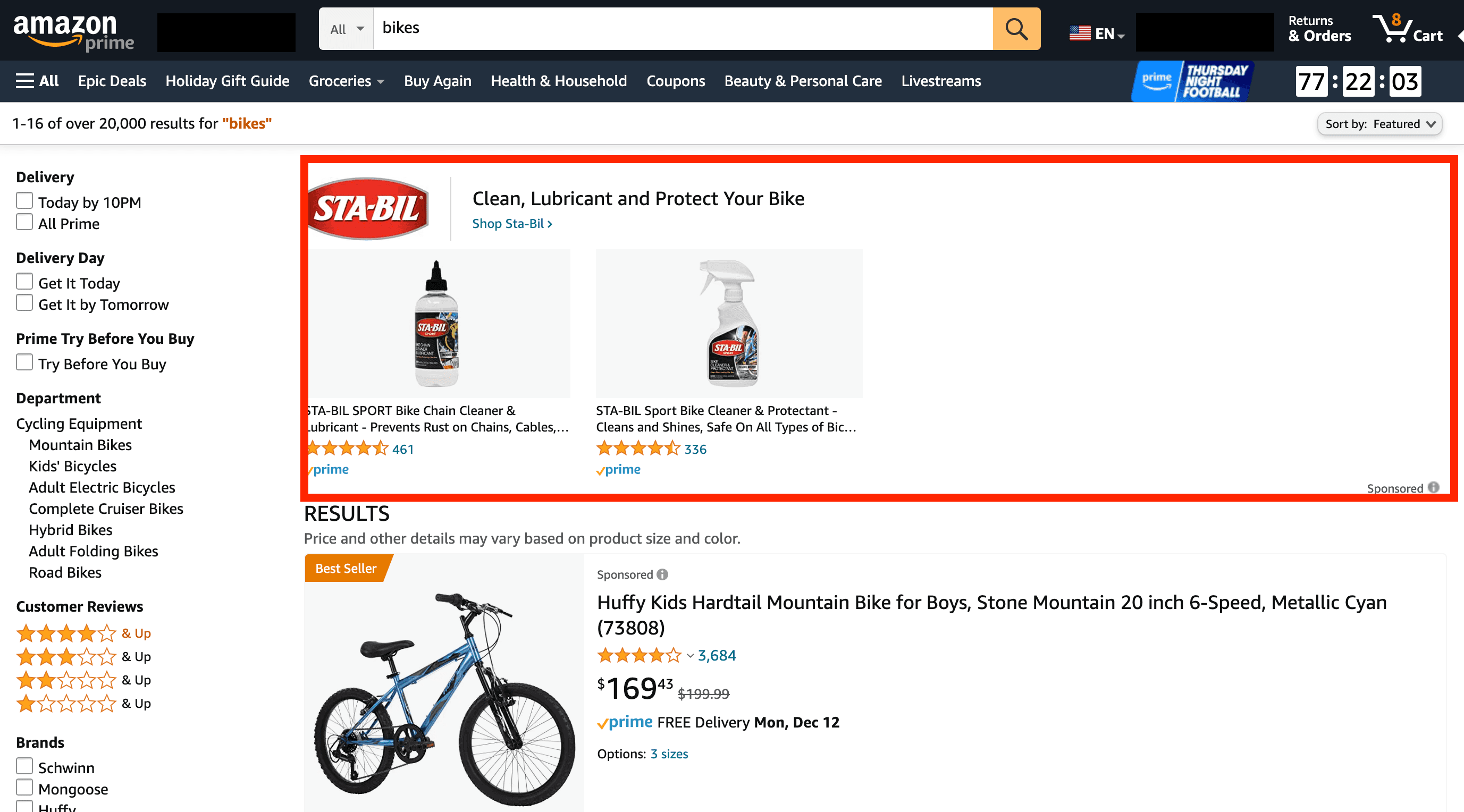

Brands like Colgate, DeWalt, or Sony want to reach retailers' consumers via advertising to drive more product sales. For example, if your brand sells bike cleaners, you can now advertise on bike-related websites or marketplaces like Amazon and sell directly to customers as they shop for related products. These advertisements are often direct product placements that enable consumers to purchase seamlessly through the retailer's digital experience.

Data clean rooms power this relationship between retailer and brand. They provide a secure environment where customer data can be shared anonymously, raising no concerns about sharing sensitive PII data and staying compliant with customer privacy regulations.

How to build a retail media network

Customer data is the key component for building a retail media network. Without first-party data targeting capabilities, brands will be prevented from personalizing their ads and achieving great ROAS.

Many companies rely on loyalty programs to power their retail media networks. They help to collect first-party data like purchase and browsing history and create a flywheel effect: customers make purchases, gain loyalty recognition, and are encouraged to shop more, further enhancing personalized experiences and loyalty.

With first-party data available, you must decide what channels you will make available. These channels can be grouped into two categories: onsite and offsite. Onsite locations refer to channels directly owned by the retailer, such as their website, app, or physical stores. Ads on these channels are displayed natively within the retailer's ecosystem. Offsite locations are not owned directly by the retailer but are accessed through accounts on email and social channels.

Then you need to think about how you’ll manage the ads on your channels with your advertisers. Will it be through a platform where advertisers can self-serve their campaigns or communicate with an account team. A platform reduces the amount of human interaction needed but comes at developer costs. At the same time, an account team can be seen as considerably less expensive but requires human power.

You'll also need to determine how to deliver ads and get the target customers into the retail media channels. One of the most effective ways to do this is with a composable CDP. A composable CDP allows you to send your customer data from your warehouse to the advertising destination, saving you from manually doing this.

Lastly, you need to close the loop on attribution so advertisers know how their ads are performing. Attribution on offsite platforms requires uploading conversion events from the advertiser, which can be difficult. Onsite, however, offers a closed-loop attribution because the customer's entry point and the final conversion happen on the retailer site, meaning you have the full customer journey and can provide advertisers with insights on what ads are performing the best.

Types of retail media networks

Advertisers can use various retail media platforms to power their advertising campaigns, offering different benefits and use cases.

| Channel | Overview | Use Case |

|---|---|---|

| On-site | Digital platforms owned by the retailer, such as websites or mobile apps | Target specific users/audiences with sponsored product listings |

| Off-site | Third-party platforms where the retailer owns the account | Retarget customers on retailer's social media accounts |

| In-Store | Advertisements in a physical store, such as digital displays, audio ads, window displays, and product demonstrations | Reach a broad audience in a geographical location, during key events, or seasonal months |

| Search-based | Display ads at the top positions of certain keywords | Create sponsored ads on Google promoting a product on behalf of a brand |

| Connected TV (CTV) | Advertisements on Smart TVs | Embedding a display ad on the home screen of a user |

| Communicate 1:1 with the customers on the retailer's email list | Include advertisement within a certain email, targeted to a certain segment |

Closing thoughts

As privacy regulations tighten and the cookieless world becomes a reality, more marketing teams will shift digital advertising dollars and efforts to platforms and channels that center on first-party customer data.

This is a perfect opportunity to build a strong data foundation, leveraging and activating your first-party data across all your channels. To power this new revenue stream, you need to synthesize your customer data, build audiences, and activate them on your onsite and offsite locations.

A composable CDP like Hightouch can help by accessing all your customer and product data within your warehouse and automatically sending it to your downstream tools. To learn more, book a demo with one of our solutions engineers.